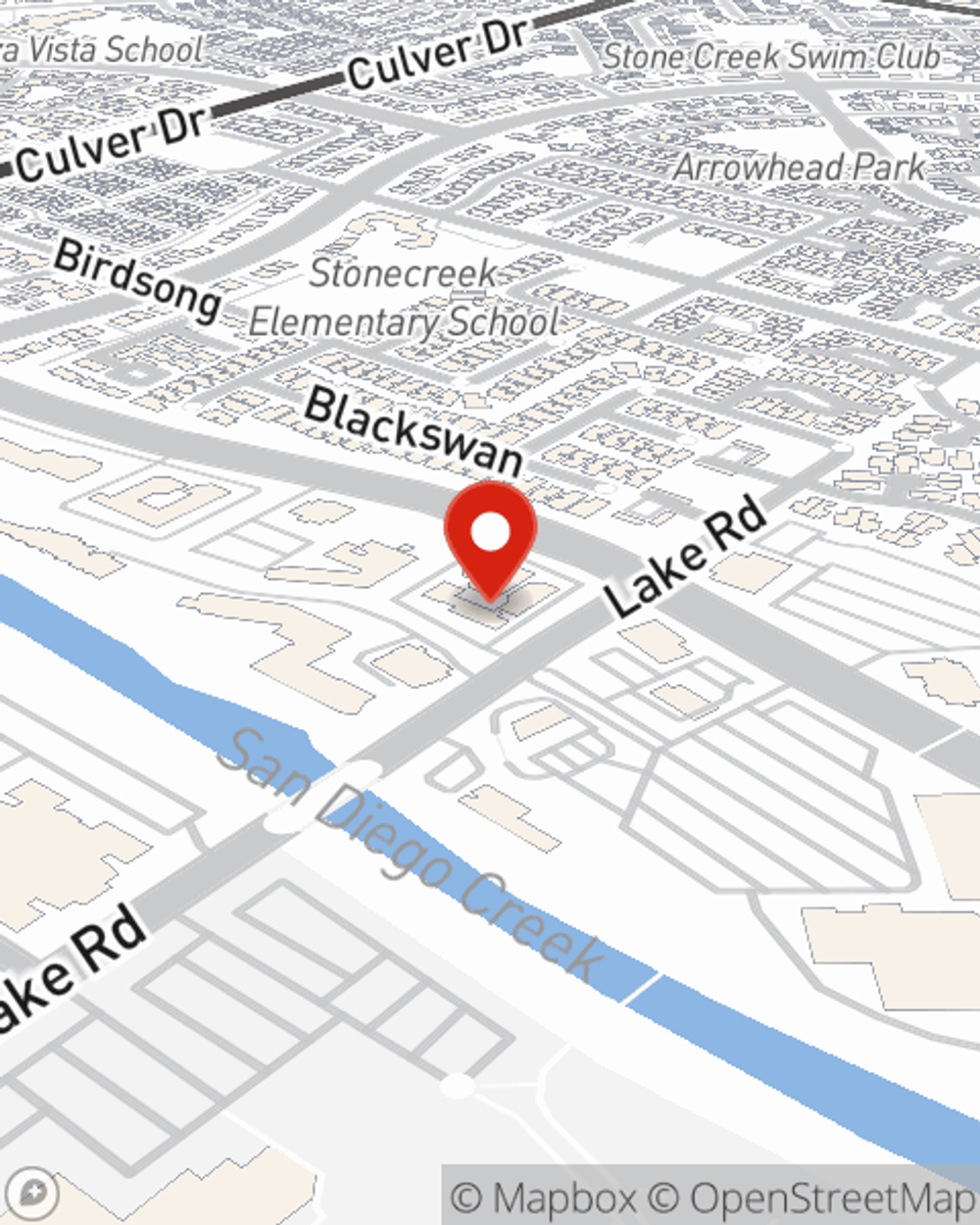

Life Insurance in and around Irvine

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Irvine

- Woodbridge

- Shady Canyon

- Newport Coast

- Turtle Rock

- Quail Hill

- Irvine Spectrum

- Turtle Ridge

- Woodbury

- Cypress Village

- University Town Ctr

- Northwood

- Northpark

- Oak Creek

- Stonegate

- Westpark

- The Groves

- University Park

- Walnut

- Orangetree

- Great Park

- Northwood Point

It's Never Too Soon For Life Insurance

No one likes to think about death. But taking the time now to secure a life insurance policy with State Farm is a way to demonstrate love to the people you're closest to if death comes.

Protection for those you care about

Now is a good time to think about Life insurance

Life Insurance You Can Trust

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Scott Stevens. Scott Stevens is the understanding associate you need to consider all your life insurance needs. So if you pass away, the beneficiary you designate in your policy will help your family or your partner with current and future needs such as ongoing expenses, grocery bills and phone bills. And you can rest easy knowing that Scott Stevens can help you submit your claim so the death benefit is paid quickly and properly.

When you and your family are protected by State Farm, you might relax because even if the unexpected happens, your loved ones may be covered. Call or go online today and discover how State Farm agent Scott Stevens can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Scott at (949) 552-6602 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Scott Stevens

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.